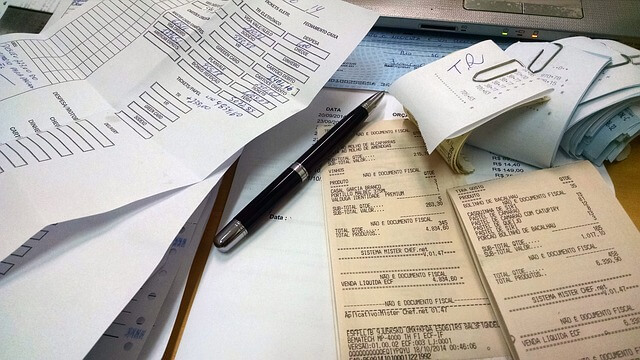

Like most bookkeeping and accounting businesses, we still get small business owners contacting us with shoeboxes or plastic bags full of receipts, tales of woe about how they tried to keep on top of their bookkeeping but it got away on them, and questions about whether we can fix up their system.

As a general rule, we can. But when we inquire what took them so long to get help, they tell us they do business in an isolated place and were unaware of any who could help them in their area. Or they say they held off because they couldn’t afford a full-time bookkeeper.

There are a lot of reasons for not getting your bookkeeping set up right when you open your small business. However, the biggest reason why you should is that it will save you a lot of money and stress in the long run.

A good analogy to explain the importance of expert bookkeeping to business is to cite the example of a chef going into a kitchen to make a magnificent meal for 10 people.

If the chef has no idea what the budget for the meal is, or how much food each person is likely to consume, and whether the tools he needs are on sight or in his repertoire, and if they have been maintained, it is virtually impossible for him or her to make a quote that guarantees them a profit.

If the chef starts looking for answers to those questions and can’t find them in a timely fashion, the job will likely go to someone else.

Your small business needs a capable bookkeeper to ensure that the information you need is ready for you and accessible when you need it, that the person keeping the records has an eye ahead to handling taxes, and that you are aware of what things cost per unit. You also need to know what your budget is and how well you are achieving it.

You need to ensure that you are compliant with provincial and federal laws as well.

The traditional excuses of not being able to find a good bookkeeper in isolated regions or one willing to work full time can be put to rest with the growth of outsourced bookkeeping services offered by firms like Piligrim Accounting.

You are able to find packages that give you the number of hours of week or month that you require services, and through the use of Cloud accounting, you can access the data you need 24 hours of the day, seven days a week.

Another issue small business owners have for avoiding professional bookkeeping services is that they believe they can’t afford them.

While you may not be able to afford a full-time staff bookkeeper, there are affordable packages from firms like ours who do the work outside of your office.

Remember that you will also save money in the long run if your bookkeeper keeps you from incurring late payment costs for invoices, ensures a smooth cash flow, keeps up with your sales tax and payroll tax withholdings and other issues.

When tax season rolls around, there is no panic and the dumping of bagsful of receipts. Everything is on hand to ensure that you are able to claim the deductions you deserve.

Outsourced bookkeepers are generally held to a high standard and their work is checked by a supervisor.

To avoid issues when the person handling your account is on holidays or ill, we ensure in our company that every account is handled by two people. If one is away, someone is still there to take your inquiry and be familiar with your business and its finances.

Despite the accessibility, the outsourced bookkeeper is not working directly for your firm, so his or her recommendations come from efficient impartiality, not because they have a special interest in one area in which you hope to invest.

They are also more likely to be straightforward with you about how your financial health is.

Their goal is to ensure the records are kept properly and you have the knowledge that you need to make good business decisions. They are not going to tell you what they think you want to hear because they want you to like them or promote them.

Because they work with multiple clients across the country, they also have a broader base of experience to pick up on circumstances that raise red flags. If suddenly expenses go through the roof, for example, they will be more inclined to bring it to your attention just to ensure that you are aware of a substantial change in your normal business routine.

Having up to date financial records is particularly important to build a reasonable budget and live within it. It also helps you to quote on projects more accurately when you can quickly review specific cost figures for labor, goods, etc.

Ensuring that you get your business off to a good start with a competent and experienced bookkeeper is vital to the success of your small business. Don’t wait until you are drowning in a sea of unfiled paperwork to outsource your bookkeeping.

Certified professional bookkeeper and certified tax specialist Elena Ivanova is managing director of Piligrim Accounting Inc., a national accounting and tax preparation service based in Richmond Hill, Ont. You can reach her at elena@piligrim-accounting.com.